Our credentials

Environmental, social and governance (ESG) factors are important investment performance drivers, from both a return and a risk perspective. We use ESG insights across our whole offering to generate value for clients.

Our credentials

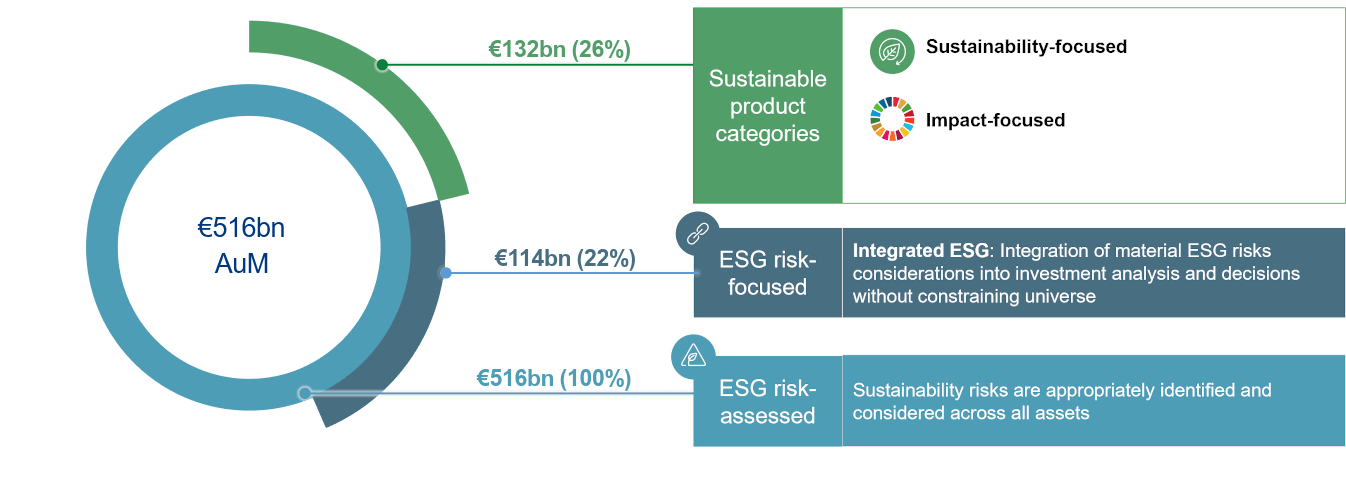

AllianzGI provides ESG risk-focused products and a range of Sustainable product categories that cater for our client’s sustainability objectives and preferences. All asset classes are ESG risk assessed.

Data as at 30 June 2022.

Total assets under management are assets or securities portfolios, valued at current market value, for which Allianz Asset Management companies are responsible vis-á-vis clients for providing discretionary investment management decisions and portfolio management, either directly or via a sub-advisor. This excludes assets for which Allianz Asset Management companies are primarily responsible for administrative services only. Assets under management are managed on behalf of third parties as well as on behalf of the Allianz Group. Source: Allianz Global Investors. Any differences in totals are due to rounding.

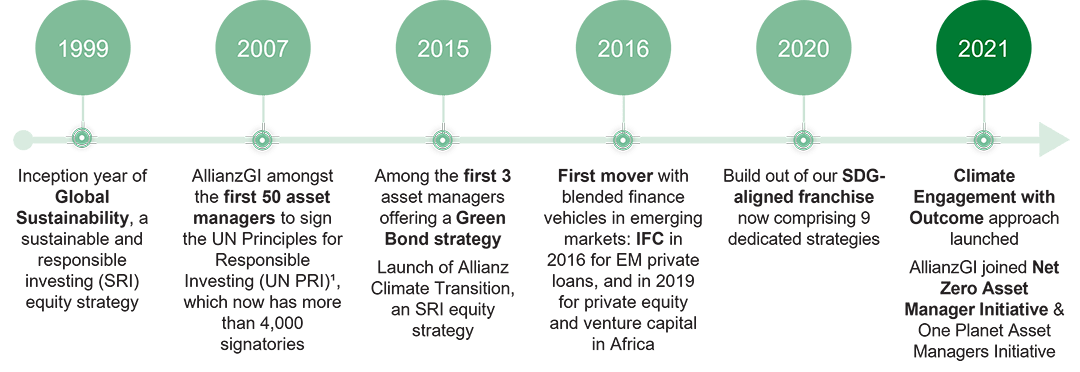

Source: Allianz Global Investors, 2021. ESG: Environmental, Social and Corporate Governance. 1 https://www.unpri.org/signatories/signatory-directory. The PRI assessment report is based on information reported directly by signatories. Moreover, the underlying information has not been audited by the PRI or any other party acting on its behalf. This is for illustrative purposes only, not a recommendation to invest in any security/strategy.

Our ESG strategy acknowledged by PRI

AllianzGI was awarded an ‘A+’ rating for its overarching approach to ESG Strategy and Governance for the fourth year in a row. This category encompasses ESG policies, objectives, memberships and considers how the firm promotes ESG efforts internally and externally.

Overall, AllianzGI achieved the highest possible, ‘A+’ score for five categories: Strategy & Governance, Listed Equity – Incorporation, Infrastructure Equity and, for the first time, Listed Equity – Active Ownership and Fixed Income – Corporate Non-Financial.

| Module name | AllianzGI score 2020 |

AllianzGI score 2019 |

Median score 2020 |

|---|---|---|---|

| Strategy and Governance | A+ | A+ | A |

| Listed Equity - Incorporation | A+ | A+ | A |

| Listed Equity - Active Ownership | A+ | A | B |

| Fixed Income - SSA | A | A | B |

| Fixed Income - Corporate Financial | A | A | B |

| Fixed Income - Corporate Non-Financial | A+ | A | B |

| Fixed Income - Securitised | A | A | B |

| Infrastructure Equity | A+ | A+ | A |

The annual assessment report from the PRI Association (“Principles for Responsible Investment”) looks at signatories' progress incorporating ESG factors into investment decisions, and aims to provide feedback to support the ongoing development of signatories' ESG credentials.

The PRI Assessment Report aims to provide feedback to signatories to support ongoing learning and development. Each module score ranges from "A+" (highest score) to "E" (lowest score) and is calculated from a respective set of indicators grouped together in module specific sections. 2020 scores refer to reporting period January 2019 – December 2019, while 2019 scores refer to reporting period January 2018 – December 2018.

Source: Allianz Global Investors. Any differences in totals are due to rounding. Impact comprises different strategies targeting climate transition, environmental projects and renewable energy. Environmental, social, governance (ESG); Sustainable & responsible investing (SRI). Allianz Global Investors supports the UN Sustainable Development Goals (SDGs). The PRI assessment report is based on information reported directly by signatories. Moreover, the underlying information has not been audited by the PRI or any other party acting on its behalf. The Sustainable Development Goals (SDGs) are a collection of 17 global goals designed to be a "blueprint to achieve a better and more sustainable future for all". The SDGs were set in 2015 by the United Nations General Assembly, intended to be achieved by 2030

1105452