Our 2020 vision: sustainable strategies may offer a path through volatile markets

In 2020, we expect markets to pivot between embracing and avoiding risk as they process muted economic growth, low rates and heightened political uncertainty. Consider managing risk actively rather than accepting volatile index returns, and think beyond the benchmark by investing sustainably and adopting thematic approaches.

In recent years, headlines about interest rates, politics, trade, climate change and other critical issues have caused wide market swings. Given the upcoming US elections, continued trade wars and the late-cycle global economy, we expect markets could be even more sensitive to news flow. This will likely result in an increase in “risk-on/risk-off” trades – moving toward higher-risk investments when economic and policy indicators improve, and toward “safer” investments when they fall. As a result, beta could stay suppressed and volatile, which we believe will make active investment management and asset allocation increasingly important.

Takeaways for investors

- Be selective among highly valued markets while searching for opportunities in cheaper ones that also generate return potential from dividends or income. We could see attractive returns from less volatile dividend-paying stocks in value sectors such as energy, and from themes that capture global “megatrends” – powerful forces that could transform the way we live.

- Consider alternative investments such as private credit, infrastructure debt and equity, and absolute-return opportunities. These tend to be less correlated to equities over time, offering an additional source of diversification potential.

- Passive, index-based investments are backward-looking – their holdings are determined in the past – and can be buffeted about by news headlines. Rather than follow broad market swings passively, use active management to invest with conviction, pursuing alpha by aiming to stay ahead of market opportunities.

We believe the investment industry is at a tipping point, with sustainable investing no longer seen as a trend but rather an essential consideration in how portfolios should be managed. Sustainable investing incorporates non-financial inputs, such as ESG factors, with the aim of generating sustainable outcomes as well as strong financial returns. It’s increasingly important for asset managers, companies and investors alike:

- Asset managers are driving capital towards sustainable companies and projects that address what investors view as some of the world’s biggest challenges.

- Companies are finding that seriously addressing issues such as climate change and executive pay can help them improve their competitive positions.

- Investors are seeing proof that ESG investing can help them manage risk and improve return potential.

This widespread recognition of the importance of sustainable investing has translated into USD 12 trillion of sustainable investing assets in the US in 2018, according to the Forum for Sustainable and Responsible Investment – a rise of 38% over two years.

Takeaways for investors

- There are many ways to make sustainable investing a core part of your approach: incorporate ESG risk factors into your decision-making; focus on sustainable and responsible investing (SRI); or invest for impact by using capital to address real-world issues.

- Aligning investments with the UN Sustainable Development Goals (SDGs) – which include promoting clean water, developing clean-energy sources and eliminating poverty – is also an increasing area of interest. Investors can direct their assets towards companies and governments that support the SDGs.

- Green bonds help fund renewable energy projects, public transportation and other areas that help fight the effects of climate change. They can also deliver reasonable income potential and have historically exhibited low correlation with the broader government-bond market, meaning the two asset classes tend not to move in tandem with each other. This can help a portfolio’s overall diversification.

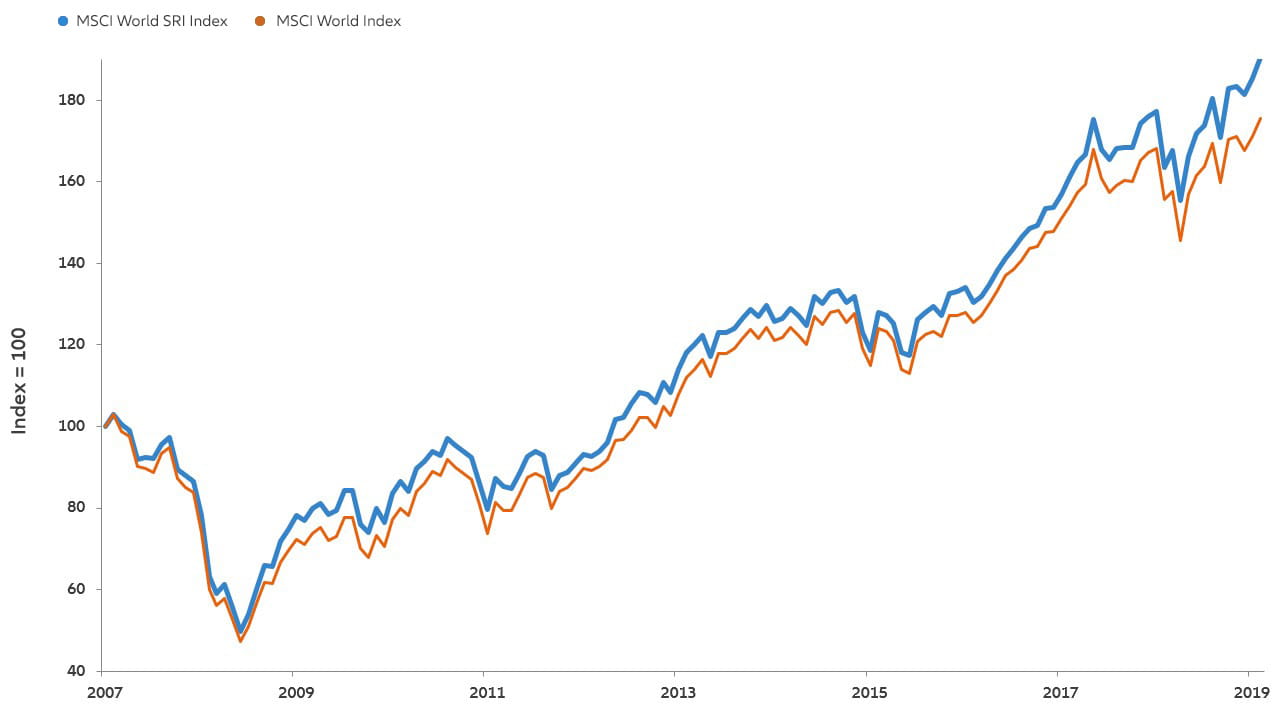

Sustainability and good performance potential can go hand-in-hand

MSCI World SRI Index vs MSCI World (9/2007-10/2019)

Source: MSCI. Data as at 31 October 2019. Start date based on oldest available data for the MSCI World SRI Index, a capitalization-weighted index that provides exposure to companies with outstanding ESG ratings and excludes companies whose products have negative social or environmental impacts. The above chart is illustrative in nature and should not be considered a recommendation to purchase or sell a specific security, strategy or investment product. Past performance is no guarantee of future results. It is not possible to invest directly in an index.

The US-China trade war has already contributed to the growth of a “tech cold war” that is giving rise to two distinct ecosystems. Tensions between the two nations are also mounting in a range of other areas, including accusations of currency manipulation and objections to adding Chinese companies to benchmark indices. The growing rivalry between the US and China could force countries and companies all over the world to choose sides. This may further interfere with the supply chains of global tech and consumer-goods firms, many of which face already renewed regulatory scrutiny. Moreover, if the trade wars continue and China becomes less reliant on Western tech, its markets might even close to the West within the next five years. This would existentially change Silicon Valley’s business model, which relies on low-cost manufacturing from China and other Asian nations.

Takeaways for investors

- The tech cold war and other US-China tensions could materially disrupt the global tech supply chain and consumer markets, creating new winners and losers. Index weightings would be slow to reflect these changes, but active managers can aim to capture related opportunities and mitigate risks.

- Big Tech firms are also grappling with other issues, including concerns about lax privacy safeguards and tax avoidance. Lawsuits and re-regulation could hurt valuations of these mega-cap stocks.

While oil prices have been relatively stable recently – hovering mostly in the USD 50-70 per barrel range in 2019 – geopolitical tensions in the Middle East could pressure the supply of oil. (The drone attacks at Saudi Arabia’s state-owned oil-processing facilities are a prime example.) At the same time, climate change is pushing more investors away from fossil fuels, potentially reducing the capital the industry can access for growth and investment.

The food-supply chain is also more vulnerable than many realise due to trade tensions, abnormal weather patterns and disease outbreaks. Food-price inflation is one of the more serious “flations”: in some instances, it slows economic growth through wage inflation; in the most serious cases, it endangers lives.

Takeaways for investors

- Renewable energy is attracting tremendous interest from corporations and investors alike, but there is a gap between the world’s ability to deliver non-fossil-fuel solutions and the current global business model, which needs fossil fuels to function. New solutions like hydrogen fuel cells and nuclear fusion reactors could fill this gap, but for now they are high-risk investments – though the potential rewards may be high as well.

- Equities in general have also shown the ability to adjust when inflation is low to moderate, typically suffering more in periods of high inflation and deflation. Many companies can cope with higher levels of inflation – including food-price inflation – by dynamically adjusting their output prices when input costs rise. This may be good for some food suppliers’ business models but doesn’t address the issue of food affordability, which can be critical for millions of people.

The transition to a low-carbon economy could require USD 1 trillion in new investments every year.

Source: International Energy Agency

Investors are increasingly interested in areas of the economy that resonate with their values and interests – for example, developing new artificial intelligence (AI) technologies or managing resource scarcity. Thematic investments can help investors align their money with their convictions about how powerful long-term shifts – sometimes triggered by innovation or regulation – might provide not just investment opportunities, but new economic growth. Thematic investments aren’t restricted to specific sectors, regions, market-cap sizes or benchmarks. This helps investors effectively capture disruptive companies and trends that could become tomorrow’s market leaders – and helps them pursue alpha in excess of market returns.

Takeaways for investors

- Water is a critical investment theme. The world has a fixed supply of fresh, clean water, yet consumption needs are rising. Opportunities can be found in companies that improve water resource management and increase access to clean water.

- AI is a growth area that is also a broad investment theme. Investors can focus on firms that provide infrastructure for AI, and invest in non-tech industries – from farming to pharmaceuticals – that are using AI in new ways.

- Pet and animal well-being is an emotionally appealing theme that touches many industries – from financials (pet insurance) to consumer staples (pet food and household products).

Annual revenue for the global pet industry is projected to grow from USD 132 billion in 2016 to USD 203 billion in 2025.

Source: Grand View Research

Related document

There is no guarantee that actively managed investments will outperform the broader market. Investments in alternative assets present the opportunity for significant losses, including losses that exceed the initial amount invested. Some investments in alternative assets have experienced periods of extreme volatility and in general, are not suitable for all investors.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG, licensed by FINMA (www.finma.ch) for distribution and by OAKBV (Oberaufsichtskommission berufliche Vorsorge) for asset management related to occupational pensions in Switzerland; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

987332