Allianz Valeurs Durables

Fund overview

The Fund aims to achieve a performance over the medium and long term by investing in Eurozone SRI-rated companies that meet the following criteria for sustainable development:

- Social policy

- Respect for human rights

- Environmental policy

- Ethics

The investment management team take into account these criteria and then add them to conventional financial criteria, such as earnings growth or recovery of firms in order to build a portfolio that offers the best possible societal and financial qualities.

3 Reasons to invest

- One of Europe’s largest SRI equity funds

- SRI “Best-in-Class” approach combined with the identification of positive dynamics (“Best Efforts”) in the stock selection process

- Track record since 2002

Opportunities

|

Risks

|

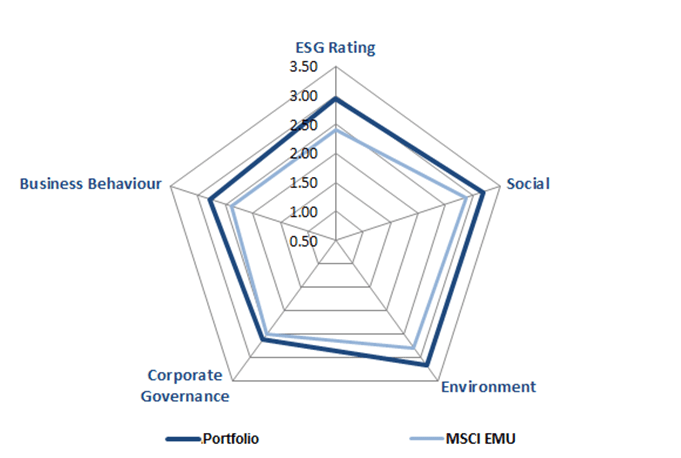

Sample ESG profile

Note: for illustrative purposes only. ESG profile as at 31.12.19. Rating scale from 0 to 4. 100% of portfolio assets need to comply with our Human Rights filter and need to have an ESG Rating higher or equal to 2 (ESG rating is calculated from a weighted average of the 4 others criteria - weighting depends on issuer sector).

1) The Morningstar Sustainability RatingTM is a measure of how well the holdings in a portfolio are managing their environmental, social, and governance, or ESG, risks and opportunities relative to their Morningstar Category peers. As of 30 June 2018 the strategies were rated 5 globes meaning that the funds stand within the top 10% within its Morningstar category in terms of Sustainability. Its Sustainability score even placed it within the top 5% of its Morningstar category.

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Allianz Climate Transition is a sub-fund of Allianz Global Investors Fund SICAV, an open-ended investment company with variable share capital organised under the laws of Luxembourg. The value of the units/shares which belong to the Unit/Share Classes of the Sub-Fund that are denominated in the base currency may be subject to a strongly increased volatility. The volatility of other Unit/Share Classes may be different. Past performance is not a reliable indicator of future results. Investment funds may not be available for sale in all jurisdictions or to certain categories of investors. This communication has not been prepared in accordance with legal requirements designed to ensure the impartiality of investment (strategy) recommendations and is not subject to any prohibition on dealing before publication of such recommendations.

For a free copy of the sales prospectus, incorporation documents, daily fund prices, key investor information, latest annual and semi-annual financial reports, contact the issuer at the address indicated below or www.allianzgi-regulatory.eu. Austrian investors may also contact the Austrian information agent Allianz Investmentbank AG, Hietzinger Kai 101-105, A-1130 Vienna. Please read these documents, which are solely binding, carefully before investing. This is a marketing communication issued by Allianz Global Investors GmbH, www.allianzgi.com, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, 60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). Allianz Global Investors GmbH has established branches in the United Kingdom, France, Italy, Spain, Luxembourg and the Netherlands. Contact details and information on the local regulation are available here (www.allianzgi.com/Info).